Uber has just released a new credit card with barclaycard, and with it also comes a new sign-up offer!

$100 Bonus Offer On The New Uber Visa From barclaycard

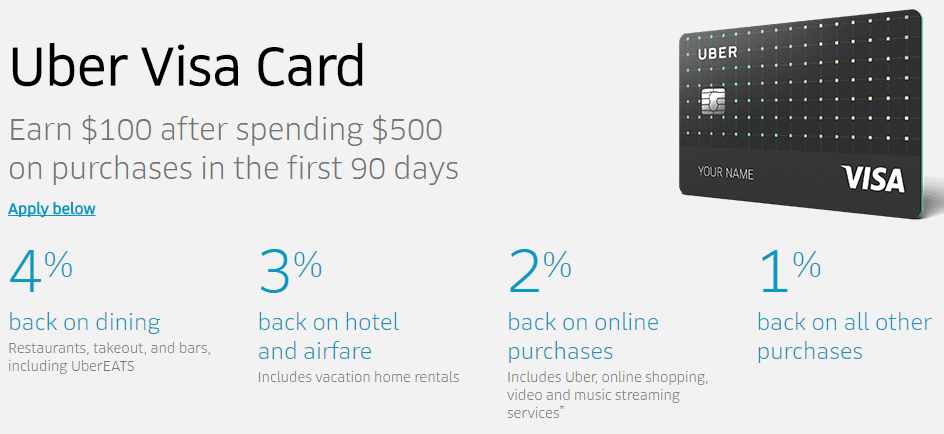

The sign-up offer is for $100 after spending $500 in the first 90 days – that’s not bad for card with no-annual fee.

About The Uber Visa Card

Let’s take a closer look at this new card. First things first – this is a $0 annual fee card.

Moreover, the Uber card actually has a pretty compelling earning structure in usable categories. It comes with 4% back on dining (near “best in class”), 3% back on airfare and hotel (very good – the same a Chase Sapphire Reserve and Citi Premier), 2% back on online purchases (loses out to the 3-4% back on the AT&T Access More Card), and 1% back on everything else (standard).

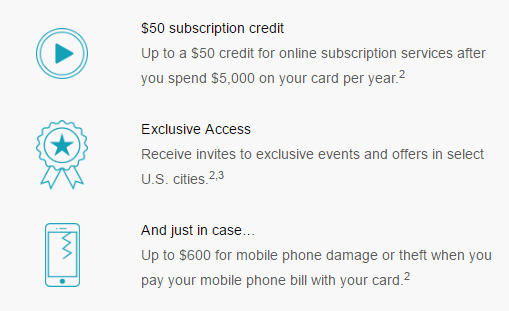

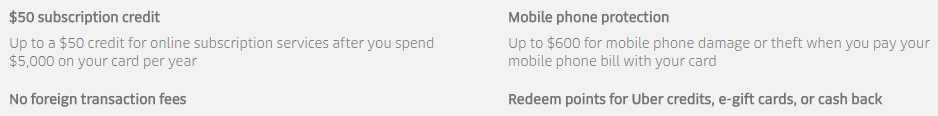

Lastly, the Uber card comes with a $50 credit toward online subscription services (think Netflix, Hulu, Spotify, etc.) when you spend $5,000 or more in a year on this card. Oh – and $600 insurance on your mobile phone when you pay your bill with the Uber Visa.

How To Redeem Points For Cash Back

Uber points are worth 1 point per cent (ppc), so 1000 points = $10.00. You can redeem Uber points for cash back, e-gift cards, or Uber credits. Check out all the FAQ’s here.

The Bottom Line: $100 Bonus Offer On The New Uber Visa From barclaycard

This is a pretty standard offer for a $0 annual fee card. Comparably, you could earn $150 on a no-annual fee card like the Chase Freedom card.

However, what really makes this card interesting is that it has a lot going for it that other no-annual fee cards don’t – namely a built-in $50 credit and strong categories for earning cash back.

Personally, I prefer the more valuable and flexible bank points, like Chase Ultimate Rewards, Amex Membership Rewards or Citi Thank You points (and the benefits that come with those cards) to cash-back cards.

But I also realize some people would just like one simple “catch-all” card, and this card seems great for that. It also appears aimed at the “millennial” demographic, as such, this is also probably a great “starter card” – with legit perks you can actually use – just remember to mind the Chase 5/24 rule in case you ever want to get deeper into travel-hacking.

Cheers!