American Express recently “reimagined” its Hilton Honors Aspire Card with a mix of new benefits, changes to existing benefits, and higher annual fees.

Is it still a “keeper”?

The Major “Reimagining” Of The Hilton Honors Aspire Card From American Express

The New Card Benefits

Here’s a breakdown of the New Benefits:

- Hilton Resort Credits: Cardholders can now earn up to $400 in Hilton property credits annually. This credit can be used for eligible purchases at participating Hilton resorts. These credits are given in $200 increments semi-annually.

- Flight Credits: Cardholders can now receive up to $200 in statement credits for eligible flight purchases. These credits are given in $50 increments quarterly.

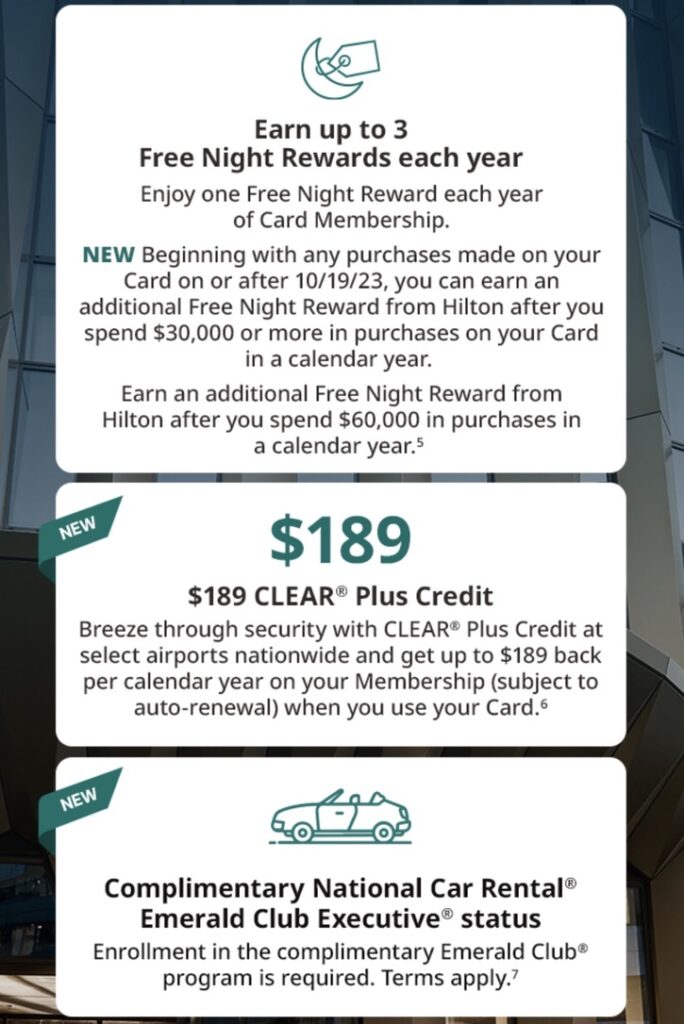

- Other New Benefits: The ability to earn more free nights, $189 CLEAR benefit, and National Car Rental Status.

Card Benefits Staying The Same

- Complimentary Diamond Status: Cardholders will continue to receive complimentary Diamond status, which includes benefits such as room upgrades, late checkout, and complimentary breakfast.

- Annual Free Night Award

- Earning Categories: Cardholders continue to earn 14x Hilton Honors Bonus Points on eligible purchases at Hilton properties, 7x Hilton Honors Bonus Points on eligible purchases at U.S. restaurants, flights purchased directly or through Amex Travel, select Rental Car companies, and 3x Hilton Honors Bonus Points on all other eligible purchases.

Other Changes To The Hilton Honors Aspire Card

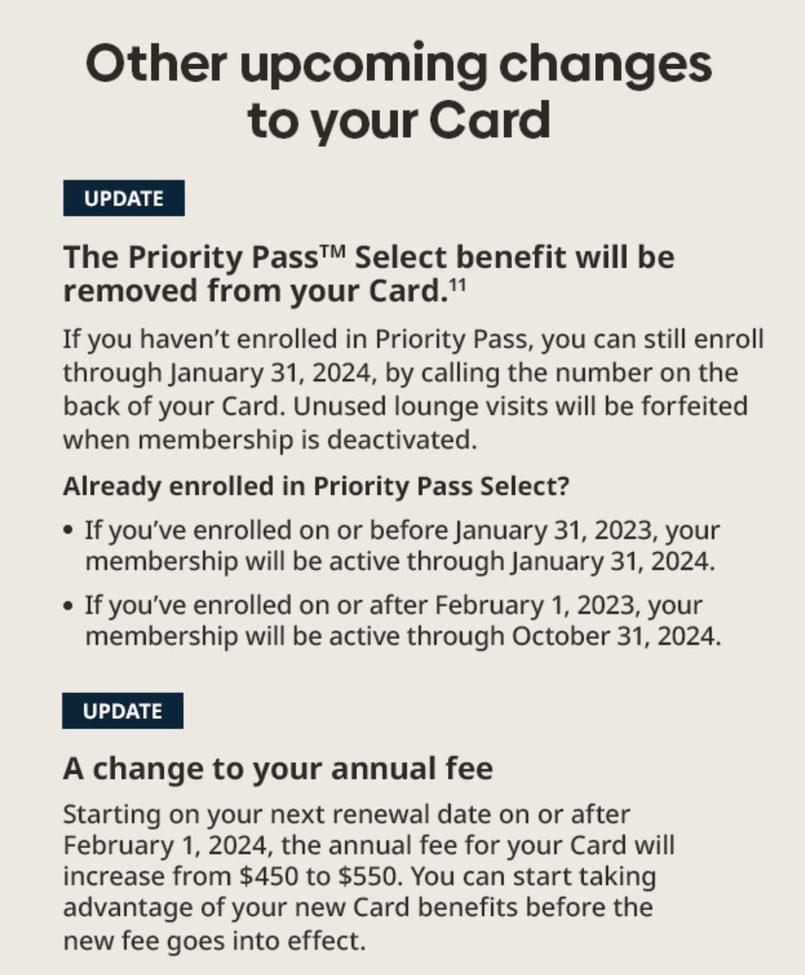

- Annual Fee Increase: The annual fee for the Hilton Honors Aspire Card has increased from $450 to $550.

- Removal of Priority Pass Select benefit: Cardholders will no longer receive the Priority Pass Select benefit.

The Bottom-Line: The Major “Reimagining” Of The Hilton Honors Aspire Card From American Express

Overall, the changes to the Hilton Honors Aspire Card are a mixed bag. The new $400 in resort credits is more valuable than the previous $250 resort benefit, but the benefit redemption structure is more annoying (and harder to track). The Flight Credit is reduced from $250 to $200 (spread out in $50 increments over 4 quarters), but is more flexible in what it can now be used on. However, the $100 increase in the annual fee may be a dealbreaker for some.

If you’re a frequent traveler who stays at Hilton properties often, the free night and complimentary Diamond status may make the card worth it. However, if you’re not a frequent traveler or don’t stay at Hilton properties often, the higher annual fee may not be worth it for you. For me, it’s still a keeper as I’m sure I’ll be able to wring out far more value than the $550 annual fee.