As with the Citi Prestige card and the Citi Premier card, so with the Citi AT&T Access More credit card. Here is a summary of the negative changes coming to the Citi AT&T Access More credit card.

Summary Of The Negative Changes Coming To The Citi AT&T Access More Credit Card

The following changes will go into effect July 29, 2018.

Roadside Assistance Dispatch Service & Travel and Emergency Assistance:

The AT&T Access More credit card even had this benefit? Who knew?

Well, it’s gone.

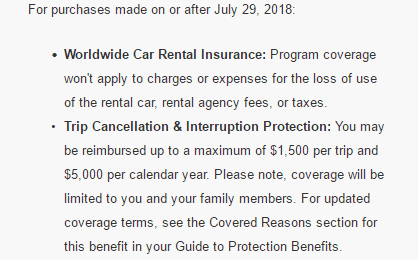

Worldwide Rental Car Insurance:

Coverage will not cover loss of use, rental agency fees, or taxes.

Trip Cancellation & Interruption Protection:

The reimbursement amount will be now be limited to a maximum of $1,500 per trip (up to $5,000 per calendar year) and cover only you and your family members (other travel companions are eliminated from this benefit).

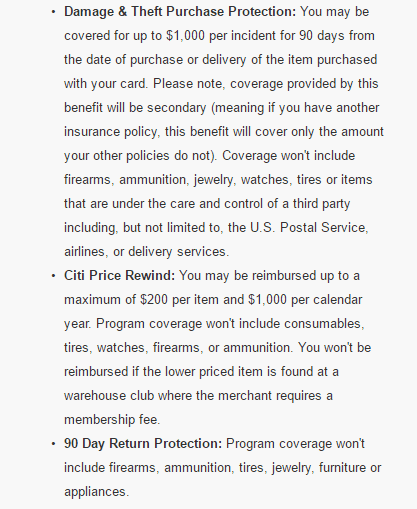

Damage & Theft Purchase Protection:

This benefit will now move to a secondary insurance policy and be capped at a maximum of $1,000 per incident within 90 days. Coverage will now exclude items such as firearms, jewelery, and watches (etc.).

Citi Price Rewind:

This is another change that will hurt. This benefit is now $200 per item – and then limited to $1,000 annually. This benefit will also now exclude items such as firearms, jewelery, and watches (etc.), as well as warehouse clubs (or establishments where a membership fee is required).

90 Day Return Protection:

The final benefit cut goes to the 90 day return protection benefit which now excludes items such as firearms, jewelery, and watches (etc.).

The Bottom Line: Summary Of The Negative Changes Coming To The Citi Premier Credit Card

At least Citi is still keeping some of the benefits key of the AT&T Access more card like Price Rewind and Purchase Protection (the latter is actually being eliminated from Chase’s competitor cards like the Sapphire Preferred card).

Although these changes are a very real devaluation, almost none of these changes are outright ridiculous. Nevertheless, they still hurt. No doubt, the devaluations are going to keep on coming. so it’s best to take advantage of the benefits when you can [now].

Cheers!