Citi announced this week they are making some major changes to the Citi Premier credit card.

The question is, “will these changes be positive or negative?”

Let’s take a look.

Major Changes Are Coming To The Citi Premier Credit Card

Officially, Citi is calling this overhaul a “redesign”.

First, The Good News

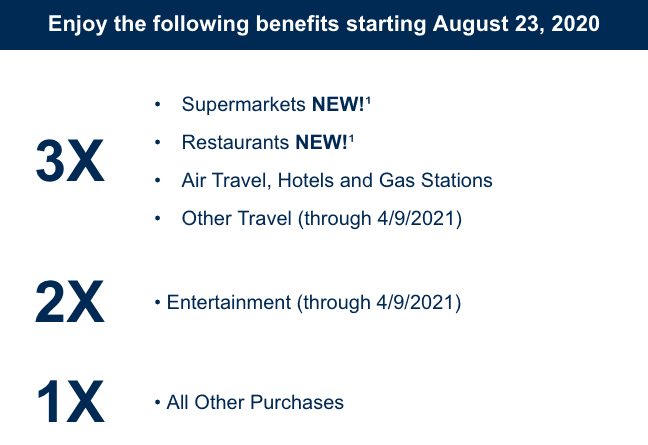

Effective August 23, 2020, Citi is upping the earning value on “restaurants” from 2X to 3X, and adding “supermarkets” as a new 3X category.

FHOP Tip: You can use World Elite Mastercards (like the Citi Premier) to earn $5 off orders on Postmates.

Now, The Bad News

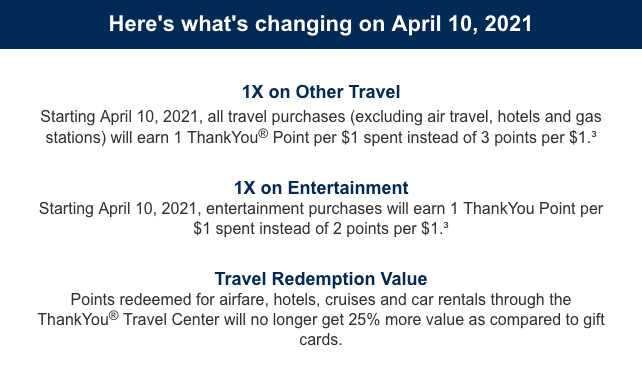

Citi is eliminating the “other travel” and “entertainment” bonus spending categories effective 4/9/2021 (on the plus side, they are keeping “air travel, hotels, and gas stations” as a 3X bonus spending category).

Worse, effective April 10, 2021, Citi will eliminate the “25% more travel value” benefit for bookings made though the Thank You travel center.

This is a huge hit for me, as I normally find this to be the best usage of my Thank You points (see my posts on Walt Disney World Swan Hotel and Walt Disney World Dolphin Hotel) now that Citi has devastated their travel protections on airfare.

But, There Is Hope For Thank You Travel Redemptions

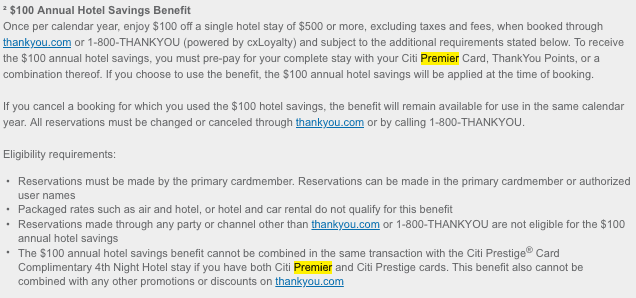

Citi is adding another new $100 annual hotel savings benefit off of hotel bookings made through the Thank You travel portal.

What’s more, this $100 annual hotel savings benefit can be used on Thank You point redemptions (see “the fine print” section below).

This is interesting because it can effectively “restore” around 20% of travel redemption value on hotel bookings (and you shouldn’t be using your Thank You points on airfare through the Thank You portal anymore anyway).

The Fine Print

What Isn’t Changing

The Bottom-Line: Major Changes Are Coming To The Citi Premier Credit Card

Overall, I believe these changes to be a net positive.

Sure, I’m really going to miss the “entertainment” spending category and the “25% more travel value” benefit.

But I suspect that with the new 3X earning categories on “restaurants” and “supermarkets”, coupled with the new $100 annual hotel credit, I’ll still come out ahead with these “redesign” changes.

The question now becomes, “do I still need a Citi Prestige credit card”?

Cheers!