Huge Change Coming to the Citi AT&T Access and Access More Cards…

It’s no secret that my secret MVP card has been the Citi AT&T Access More Card for the last couple of years. Those who have it – and were able to get it when it was still available (it’s now unavailable in credit card “purgatory”) – know that there are several amazing features unique to this card.

There is another version of this card that is still active and available on the Citi website, the Citi AT&T Access Card.

Features of the Citi AT&T Access More Card:

- Earn 3 Points for every $1 you spend on purchases made online at retail and travel websites

- Earn 3 Points for every $1 you spend on products and services purchased directly from AT&T

- Earn 10,000 Bonus Points each year when you spend $10,000

- Annual Fee $95

This card also came with a credit to AT&T stores on the qualifying purchase of a new phone (up to $650), which in my case, was used on an Apple iPhone 6s Plus.

Features of the Citi AT&T Access Card:

- Earn 10,000 Bonus Points after you spend $1,000 in purchases within 3 months of account opening

- Earn 2 Points for every $1 you spend on purchases made online at retail and travel websites

- Earn 2 Points for every $1 you spend on products and services purchased directly from AT&T

- No Annual Fee

Huge Change to Cards Earning in 3x:

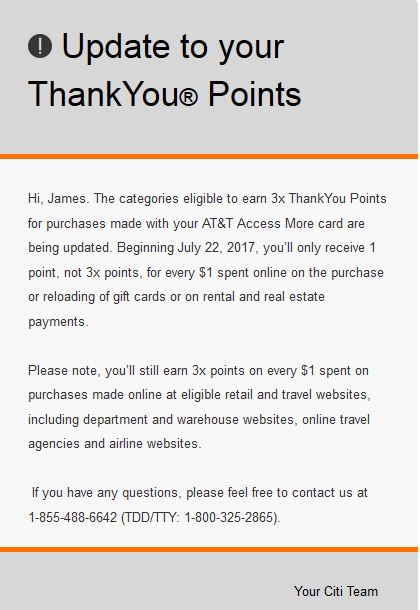

This morning, I received this email from Citi:

They’ve since also posted it for the Citi AT&T Access Card on their site:

Effective July 22, 2017, you’ll only receive 1 point, not 2 points, for every $1 spent online on the purchase of or reloading of prepaid and gift cards, or on rental and real estate payments. Please note, you’ll still earn 2 points on every $1 spent on purchases made online at eligible retail and travel websites, including department and warehouse websites, online travel agencies and airline websites.

This is Huge because one of the best known uses for the 3x Online Retail category on the AT&T Access More Card was Plastiq.com, where you could use pay your Rent and Real Estate expenses and get 3x points PLUS an additional 1x (on the first $10,000 spent). So a rental payment of $1,500 a month could be worth:

1,500 monthly payment x 4 = 6,000 Points;

And if you have the Citi Prestige Card:

6,000 Points x 1.33 (Citi Prestige Bonus) = 7,980 Points per month!

Also, the line “…the purchase of or reloading of prepaid and gift cards” seems like another big hit because another great use for these cards was the Bonus earned on Gift Cards at online retail stores such as Raise.com and Cardcash.com where you could potentially earn 3x Bonus on top of the already discounted gift cards.

Bottom Line: Huge Change Coming to the Citi AT&T Access and Access More Cards…

As you can see, this is a huge negative development, but it does appear you can continue to earn the 3x Bonus on other large expenses like Car and insurance payments, etc., not to mention 2x on ALL purchases up to $10,000.

Keep in mind you have until July 22, 2017 to take advantage of these Bonus categories until they’re gone. As always, YMMV.