It’s already been another year with great Citi AT&T Access More card. Although this card is one of the most valuable and lucrative cards I have – as with every card – its time to evaluate whether this card is worth keeping or closing before I’m on the hook for the $95 annual fee.

My Retention Offer for the Citi AT&T Access More Card:

Before making any “keep or cancel” decision, I’ve found it wise to always call the card company and see if there are any retention offers available.

I called Citi customer service at the number on the back of the card. I quickly got a representative, told her I was trying to determine if I should keep the card, and asked her straight-up if there were any retention offers available to me.

Immediately she came back and said, “why yes, in fact I have 4 offers for you at this time”. She jumped right in with, “are you ready?”, and then proceeded to read me the following offers:

Offer #1: 10,000 Thank You points after spending $3,000 in the next 6 months

Offer #2: 7,500 Thank You points after spending $1,000 in the next 3 months

Offer #3: 500 Thank You points after spending $500 in a month, for each month, for the next 16 months

Offer #4: 1x bonus Thank You point for every dollar spent, up to $35,000

Note: I had about $10,000+ worth of spending on this card during year the last year.

To Keep Or Cancel?

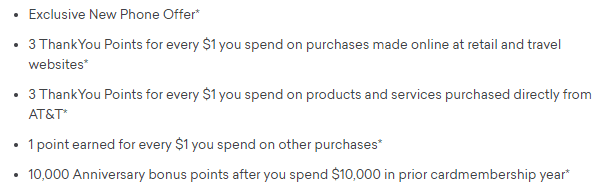

Usually, this is any easy decision with this card. Why? The earning structure is one of the best of any card:

Yes, you read that correctly – 3x on retail and travel websites plus 10,000 Thank You points every year when you spend $10,000 annually.

This effectively means – assuming you spend at least $10,000 on this card in a year – that the minimum you can earn is 2x on all purchases! It also means the most you can earn is 4x on travel and retail websites! No other card can beat that.

I value Citi Thank You points at 1.25 ppc; so 10,000 Thank You Points at 4x = $500 alone.

Which Retention Offer Did I Choose?

By my math (including the spend required to hit the bonus), I value Offer #1 at $162.25, Offer #2 at $106.25, Offer #3 at $200, and Offer #4 at $875.00 – but that’s assuming you spend $35,000 on this card alone – and that’s a major assumption.

Believe it or not, I went with Offer #2. Why you ask? Well, I was already a little extended trying to hit several welcome bonuses including the monster American Express Business Platinum card’s $10,000 in spending.

Additionally, looking at the opportunity cost, the Offer #3 and #4 didn’t make sense for me – especially when I essentially already had Offer #3 on my Citi Premier card. Besides, Offer #2 has the best “bang-for-your-buck” at 8.5x [minimum] on $1,000 spend.

Here’s The Math:

$95 annul fee – (1,000+7,500 thank you points * 1.25) = $11.25 net profit over the annual fee.

But…

There is a giant elephant in the room. Although this card has been hugely valuable to me – and even just got a surprise upgrade – it has recently gotten a major de facto devaluation, and it has everything to do with Plastiq.

It seems the AT&T Access More card is no longer earning 3x points on rent, mortgage, car payments, bills, etc., on Plastiq. I can confirm this first-hand. I can’t underscore enough how much this hurts. This was the magic card for paying bills for many years. So what to do now?

The Bottom Line on My Retention Offer for the Citi AT&T Access More Card:

In this case, I got another year of card membership and I’ll make $11.25 in the process, all courtesy of the retention offer for the Citi AT&T Access More card. I’m hoping Citi and/or Plastiq will somehow reverse course (as they’ve been known to do) and I can return to putting all my major bills on this card.

But in reality, that’s unlikely to happen, so I’m going to see if I can hit $10,000 worth of spending at online retail and travel sites alone within the card year, which should be doable and worthwhile on 3x categories.

Of course, next year I’ll have to repeat this process. But for now, I’m staying the course.

Cheers!