American Express, as they do from time to time, have just made some massive new changes to the Platinum Card.

The official line from Amex is that the changes will add “access to over $1,400 in value” – but is that really going to be true [for you]?

All The Massive New Changes Coming To The Platinum Card From American Express

Along with the new benefits added (which I’ll get to in a minute), the first thing to note is that the annual fee is increasing.

The Increased Annul Fee

The annul fee will go from $550 to $695 (an increase of $145).

But that comes with “access to over $1,400 in value”, right?

The “Access To Over $1,400 In Value”

The key phrase here is “access to”.

Will you really have a need to access the new benefits?

Let’s take a look.

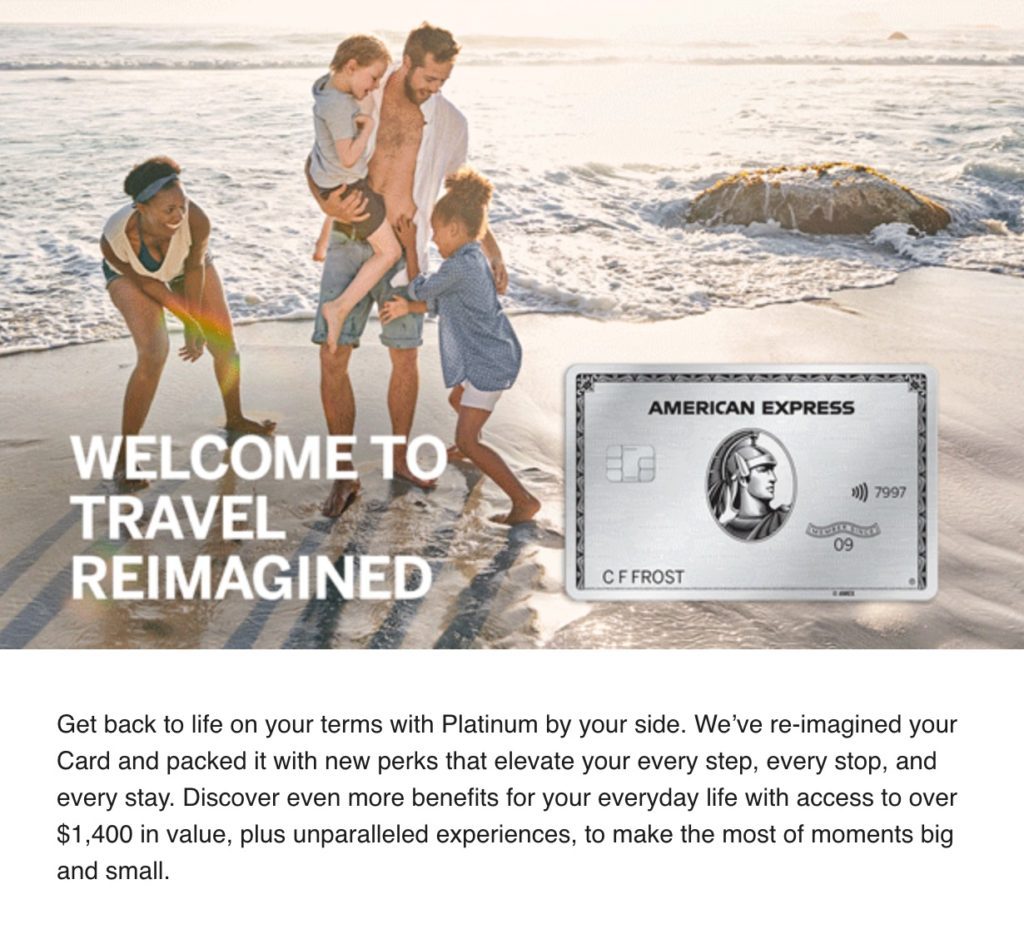

The New Benefits Of The Platinum Card

New benefits to the card include a $240 Digital Entertainment credit, a $300 Equinox credit, and $200 Hotel credit, a $179 CLEAR credit, and new cell phone protection.

The “Expanded Benefits”

There are also some “expanded benefits” – namely new Centurion Lounges (which cardholders will continue to be able to grant complimentary access to 2 guests per visit until January 1, 2023) and dining access from Resy.

The Benefits That Are Staying The Same

If you love the current Platinum benefits, fret not.

The ability to earn 5X at American Express Travel, the $200 Airline Fee Credit, the $200 in Uber cash, and the $100 Saks Fifth Avenue credit are all remaining the same.

Is The Platinum Card By American Express Still Worth It?

Ah, that’s the all-important question.

The answer? Maybe.

It all depends on which credits you value and which ones you actually use.

Here’s how the math breaks down in my situation:

- $240 Digital Entertainment Credit: I’ll use this for Peacock and SiriusXM [$17.99]

- $200 Hotel Credit: I’ll easily use this at Fine Hotels & Resorts [$200]

- $179 CLEAR Credit: I don’t have this, but I’ll get this for me and my plus one through United Mileage Plus [$109+$50=$159].

- $300 Equinox Credit: The club nearest me is $300 per month, so the $25 monthly credit (an 8% credit) is basically useless.

- Increased Lounge Access: [$50]

- $200 Annual Airline Incidental Credit: I’ll use it [$200].

- $200 Annual Uber/Uber Eats Credit: I’ll use it [$200].

- $100 Annual Saks Fifth Avenue Credits: I’ll use it [$100].

- Up to a $100 Global Entry credit: I’ll use it once every 5 years [$20]

The new total Platinum benefit value to me: $946

Less the annual fee: $695

The new net benefit value = $251

What About The Other Platinum Benefits?

Good question.

Of course the about $251 number doesn’t take into account the other benefits of this card like Priority Pass, Fine Hotels & Resorts, Amex Offers, Spending Offers, Retention Offers, etc.

When I factor in all of those benefits, I figure I can realistically come out at least $500 ahead.

Is The Platinum Card By American Express Just An Expensive Coupon Book?

Yes.

But I don’t mind an expensive coupon book if I can make a minimum of $500 on each coupon book (which I can).

The 20,000 Membership Rewards Points Limited-Time Offer

To sweeten the new deal (or cushion the blow depending on how you look at it), Amex has also been promoting the following offer in many accounts:

The Bottom-Line: All The Massive New Changes Coming To The Platinum Card From American Express

The rumor had long been that Amex was looking to transition the Platinum card from a “travel” card to a “lifestyle” card and that appears to be largely validated by the new benefits. However, “access to over $1,400 in value” doesn’t mean much without the need to access the new benefits.

With that said, I do think most card holders should still easily wring a net positive value out of the card that will justify the new $695 annual fee – as long as they don’t mind keeping track of the monthly “coupon book” (which they likely already do anyway).

At the end of the day, the Platinum Card is still a keeper in my book.